Which shall prevail – understandable optimism or emergent financial weakness?

Rational investors can often correctly differentiate between strong fundamentals and extreme optimism when it comes to predicting share price movements. However, Netflix’s stock performance has reignited this very basic question — what is more important for a share price acceleration, aggressive enthusiasm or fundamental principles of business analysis?

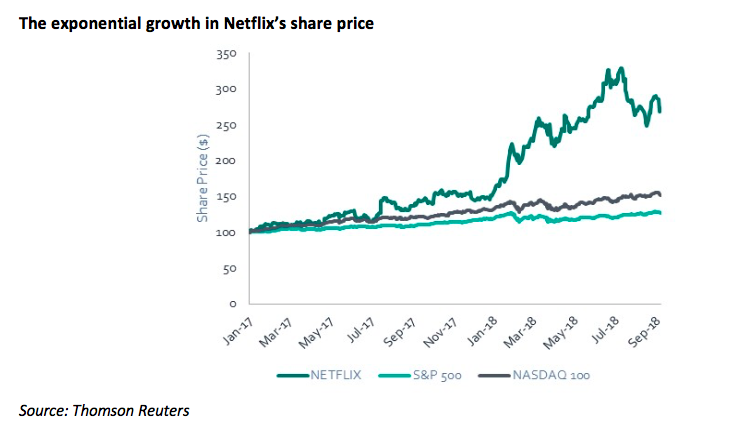

Netflix’s share price has surged 81.6% YTD^, as against 16.2% by NASDAQ and 7.4% by S&P 500. It has delivered a total shareholders’ return at a CAGR of 21.7% since its IPO in 2002. The core reason for this phenomenal growth has been an exponential expansion in its international business, which now constitutes ~56% of total paid subscribers, and contributes ~50% of total revenue (as of 30 June 2018), making it a global business.

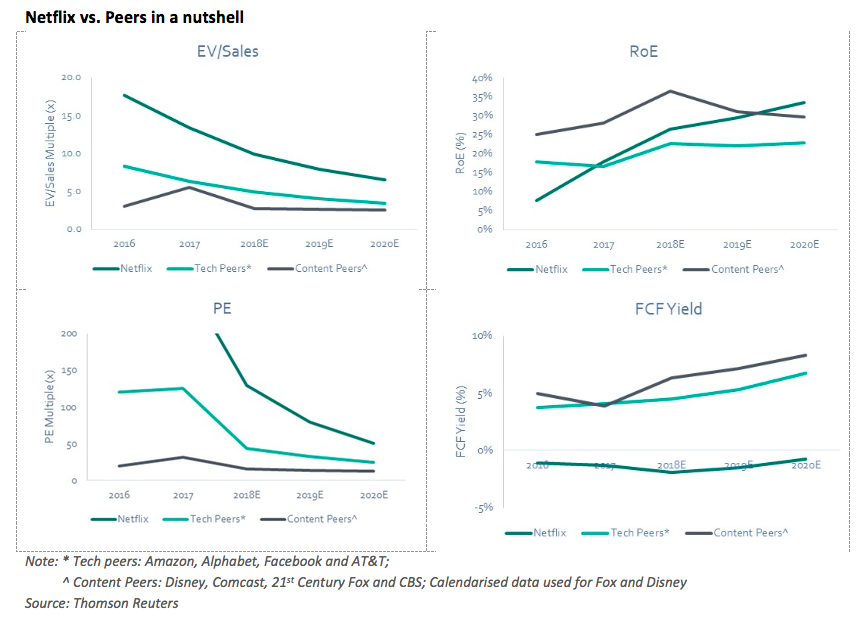

However, the superlative growth in Netflix’s share price has resulted in unsustainable valuation multiples — 2019E PE of 78.8x, as against 32.4x for Tech peers (Alphabet, Amazon, AT&T and Facebook) and 14.3x for Content Peers (Disney, 21st Century Fox, CBS and Comcast). In addition, fundamental weakness can be seen in key financial metrics: the burgeoning net debt levels (Net Debt/EBITDA of 3.4x in 2017 and 2.7x in 2016), accelerating content liabilities ($7.5bn in 2017; $6.5bn in 2016 and $4.8bn in 2015) and consistent negative FCF yields (-1.9% in 2018E; -1.3% in 2017 and -1.1% in 2016). These fundamental and valuation weaknesses have made Netflix’s share price very sensitive and reactive to growth drivers. For example, when net subscriber growth was less than expected in Q2’18, the share price dropped ferociously (current share price is 17% below peak valuation).

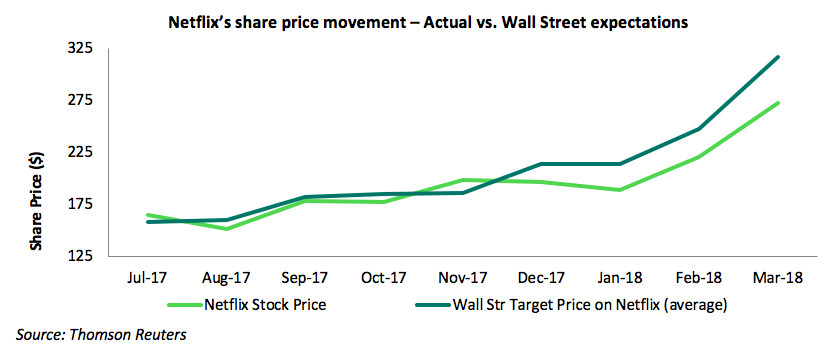

Experts have remained behind the curve in predicting Netflix’s share price movement

Sector experts, known for their smart (and often accurate) assessments, have fallen flat in the face of Netflix investors’ enthusiasm. Amidst the dilemma of whether to focus more on the subscriber growth led enthusiasm, or dragging financial covenants, even the sector analysts have remained behind the curve in correctly predicting the target share price for Netflix. This clearly shows that Netflix’s case is unique, and calls for much deliberation. But the moot question persists — what makes investors so excited about Netflix?

Leadership position with investment on ‘Localised Content’ for long term moat

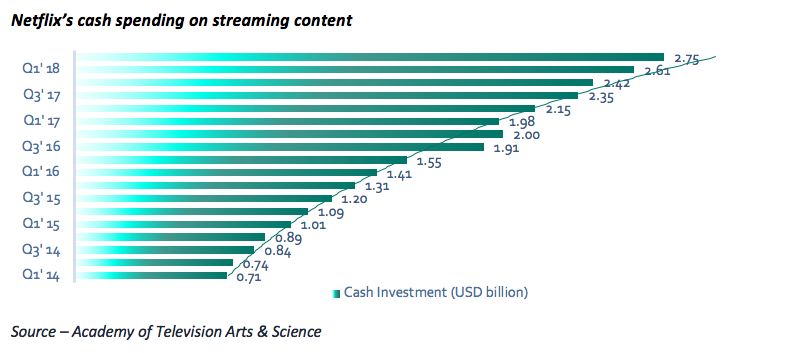

Netflix’s access to valuable customer information keeps it ahead of the competition. Realising that video streaming through over-the-top (OTT) technology will soon become omnipresent with multiple players, Netflix has started aggressively working on the remaining differentiating factor — content. Netflix has been investing heavily into expanding its library of original and exclusive content. It invested $6.3bn on original content in 2017, and plans to invest around $8bn in 2018. A large portion of this budget is aimed at a diversified international audience — across nearly 200 countries and 24 languages. Currently, Mexico, India and Brazil are Netflix’s key focus areas for local language production.

Being the first mover, Netflix has amassed huge data on viewers’ choices and preferences and consequently is able to create high-quality varied content, across genre and geography. This year, Netflix has surpassed the old-warhorse HBO in the number of Emmy nominations—112 for Netflix, in comparison to 108 for HBO. Increasingly, global viewers (and subsequently investors) are getting attracted towards Netflix. In the mature US market, Netflix’s subscriber base has been growing at an average of 2.5% QoQ for the last five quarters. Similarly, the tailor-made non-English content is attracting subscribers across its international markets—average subscriber growth of 8.7% QoQ over the last five quarters.

So, can Netflix satisfy viewers and investors?

The continuously improving library of original content differentiates Netflix’s service and should help safeguard its market share over any new service in future. This has kept investor confidence and enthusiasm high, leading to the exponential increase in the share price. The recent share price correction is more of a rationalisation exercise, and not a rerating due to any tangible financial weakness. Netflix’s continuous efforts and leadership in the world of content should keep the share price momentum going and deliver gains to shareholders, but only to the patient ones!

The Smart Cube helps Financial Services businesses make better-informed investment and lending decisions faster, and drive sustainable growth in a time of unprecedented economic change and disruption. Find out more about our Investment Research and Analytics solutions, including Credit Research and Equity Research.