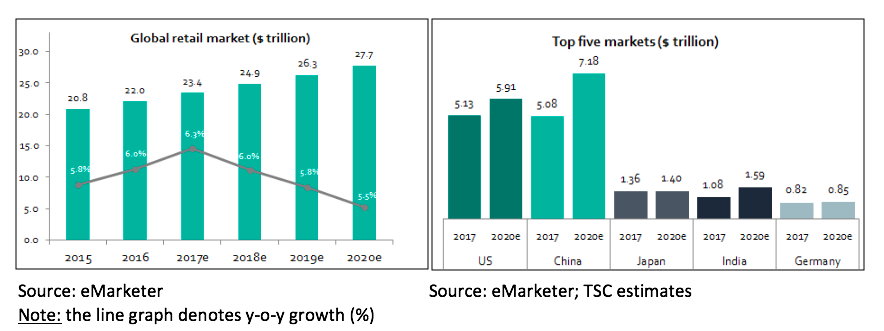

While the economic pundits are figuring out the implications of a US-China trade war, the retail giants from these countries are already engrossed in a fierce battle, sending tremors across the continents. This is the era of the Amazons and the Alibabas.

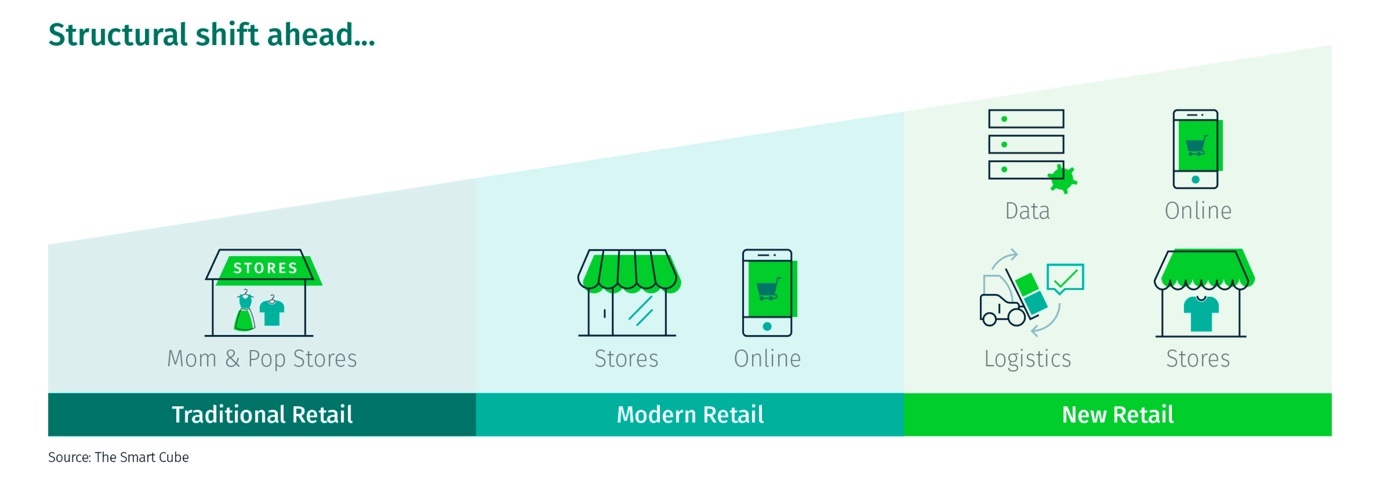

In the last 20 years, the retail industry has shifted from being predominantly brick-and-mortar, with key players confined to one country/region (where international success was limited to the likes of Wal-Mart and Aldi) to a global e-commerce playing field. The late nineties saw the disruptive seeds of Amazon and Alibaba being sown. Their swift ascent not only popularised e-commerce among the masses, but also changed the competitive landscape, possibly forever.

Parallels can be drawn between these retail giants over the past two decades. Both swiftly conquered their domestic markets (and catalysed numerous bankruptcies amongst weak non-food retailers in the process), both are technology-driven and deep-pocketed. Both also failed to enter each other’s territories, and recently penetrated the offline format despite a pure-play online background – each grabbing around 50% of the e-commerce market in their home countries, the world’s two biggest retail markets (controlling approximately 43% of global retail sales).

Enter Walmart

In response to the emergence of these dominant online retailers, the world’s largest retailer (by revenue) Wal-Mart, which had long underestimated ‘the power of the click’ sought solace and a share of new online profits, in the Chinese internet giant Tencent. Tencent own the popular Chinese ‘app for everything’ WeChat and around 18% in Alibaba’s arch-rival JD.com. By early 2017, this Tencent-led trio had emerged as a formidable third front in the e-commerce battleground.

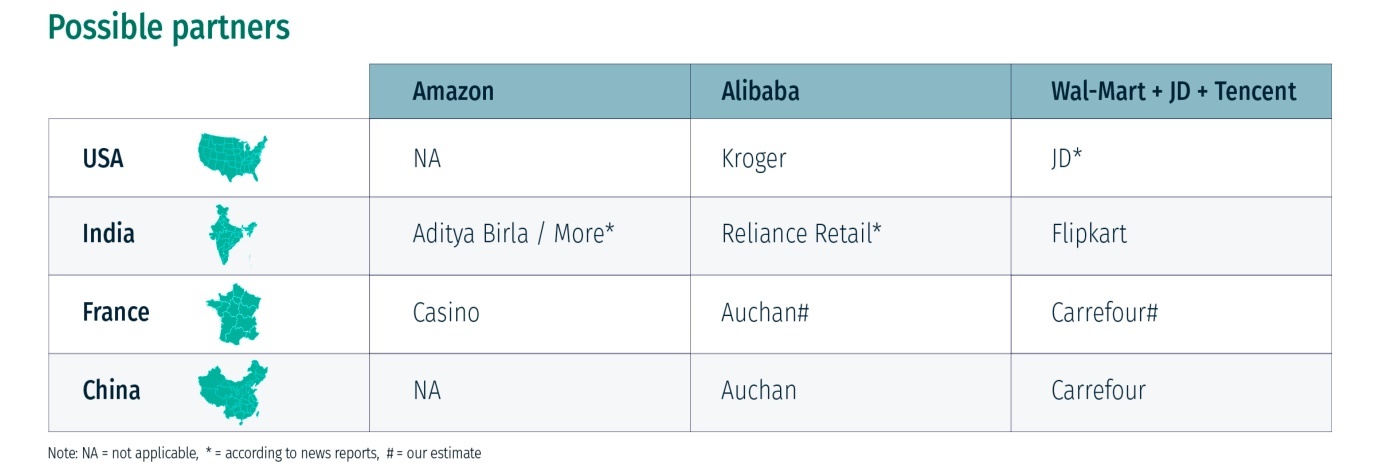

Other prominent retailers stood by while Amazon, Alibaba and the Tencent, JD.com and Wal-Mart partnership cemented their hold on their home turfs, largely non-food. The likes of Kroger, Carrefour and Sainsbury (ranked second in the US, France and the UK, respectively) also drew comfort from their high reliance on grocery (where e-commerce still accounts for just 2% of revenue vs approximately 10% in non-food) and consumer preference to choose consumable products in person.

Winds of change

However winds changed course again the day Amazon announced its $13.7bn acquisition of Whole Foods in June 2017. Jittery investors immediately thrashed almost every grocer black and blue. Amazon’s ‘don’t give a damn’ attitude over short/mid-term profits, its widespread use of disruptive technology (such as AI, sensors, cameras at its fulfilment centres, and the use of Big Data in its customer engagement), as well as Jeff Bezos’s love for evergreen businesses, made traditional grocery stores sitting ducks. It also quickly outpaced the Chinese giants – still valued at around half a trillion dollars – while Amazon zoomed past the $900bn-mark within 12 months.

At the same time, these three leaders took a big leap towards omni-channel – marrying e-commerce with stores, leveraging data analytics to better understand and predict customer behaviour and deploying best-in-class last-mile-delivery networks. Jack Ma, co-founder and chairman of Alibaba, coined this as the ‘New Retail’. Who would have imagined a few years ago that consumers would place orders over Alexa or that machine learning/predictive analysis would help grocers run targeted marketing campaigns to underpin profitability?

The amalgamation of technology with operations is where new retail succeeds, but is proving a hard nut to crack for traditional retailers. This is where Google and Microsoft sensed the opportunity and joined hands with Wal-Mart (part of the Tencent camp). Microsoft is reportedly offering a replica of ‘Amazon Go’ in the US, while Google has presented its voice-assistant plus online shopping mall to Wal-Mart.

Throw in their ambitious expansion plans in untapped geographies, and it’s no surprise that many technology-hungry retailers are finding success. For instance, Carrefour has signed up with Tencent in China, while its peer Auchan has joined Alibaba. We would not be surprised if JD.com, already planning French entry in 2019, decides to partner with Carrefour.

The next battleground

The battle is already on in South-east Asia. While Alibaba is fighting Amazon in Singapore (after Alibaba acquired Lazada), it is going up against JD.com for a slice of the underdeveloped Indonesian market.

However, one of the most potentially lucrative three-way contests has commenced in India where the e-commerce market is expected to reach $100bn by 2020 (from $53bn in 2017). This battle was initially confined to Amazon and Flipkart (with around35-40% market share each) until Wal-Mart joined the fray by acquiring 77% of Flipkart, with Tencent and Microsoft as minority shareholders. If news reports are true, Google may also soon be getting involved. In addition to this deal, Amazon has teamed up with Samara Capital to acquire Aditya Birla Group’s supermarket chain ‘More’. Alibaba is already present through e-tailers Paytm Mall and Big Basket, and is allegedly eyeing an alliance with Reliance Retail (owned by Mukesh Ambani, India’s richest man, who recently announced big expansion plans in the omni-channel format). Only time will tell which of the online retail giants will win.

The Smart Cube helps Financial Services businesses make better-informed investment and lending decisions faster, and drive sustainable growth in a time of unprecedented economic change and disruption. Find out more about our Investment Research and Analytics solutions.