Palladium prices have been rising dramatically in recent years, skyrocketing from $500/oz in 2016 to nearly $1,700/oz at the time of writing. With prices now outstripping gold, it’s become one of the market’s favourite precious metals. So what’s behind the palladium boom, and how long will it last?

A catalyst for reduced vehicle emissions

Palladium is one of the platinum group metals (PGMs), along with platinum and rhodium, and makes up just 0.0005 parts per million of the Earth’s crust.

This metal is used in electronics, dental prosthetics and jewellery, and for investment, but its most common use by far is in catalytic converters for petrol-powered vehicles.

More than 80% of the world’s palladium supply is purchased by automotive manufacturers for the purpose of oxidising carbon monoxide into carbon dioxide, a function it performs more efficiently and reliably in petrol vehicles than platinum.

Demand for palladium has been rising ever since the 1970 US Clean Air Act initiated a growing clamp down on vehicular emissions. The ensuing mass adoption of catalytic converters has seen the automotive sector’s annual palladium consumption swell from 0.3 Moz in 1980 to 8.7 Moz in 2018.

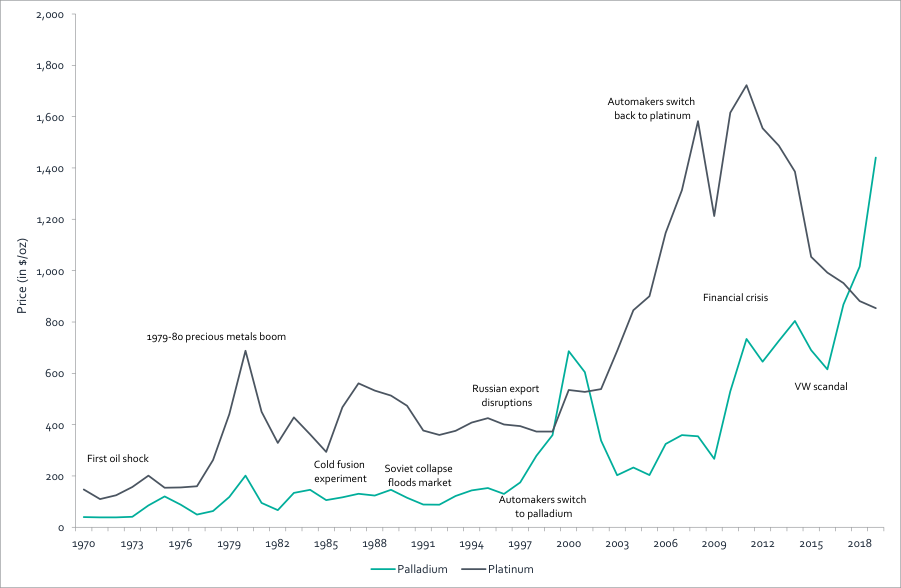

PGM pricing evolution

Sources: USGS; CRB; Winton; The Smart Cube subscribed databases

Emissions scandals and supply risks driving palladium prices

Palladium’s primary use means its price is inextricably linked with the global market for petrol vehicles – and here we find one of the main drivers of the current palladium boom.

Since the Volkswagen diesel emissions scandal of 2015, petrol vehicles have been vastly outselling diesel vehicles. Even in Europe, the world’s largest diesel vehicle market, the percentage of diesel vehicles sold has fallen drastically from 52% in 2015 to just 36% in 2018.

Recently, global macro uncertainties and oil price shocks, and the US dollar’s resultant volatility, might have forced investors to run for the safe-haven cover of palladium.

Uncertainty over the security of palladium supply has also been pushing up prices. The two largest palladium-producing countries, Russia and South Africa, account for around 80% of the world’s supply. But both countries have ongoing socio-economic and political struggles, and two events in particular raised supply certainty concerns:

- The risk of secondary sanctions against Norilsk Nickel, the world’s largest palladium producer by output. Aluminium producer Rusal has a c.28% stake in Norilsk, which led to fears that US sanctions against Rusal might be extended to Norilsk.

- Concerns around the long-term survival of Lonmin, one of South Africa’s key PGM mining firms. Lonmin had been battered by the falling price of platinum; caused by oversupplies and declining demand for diesel vehicles, where platinum is a key component of catalytic converters.

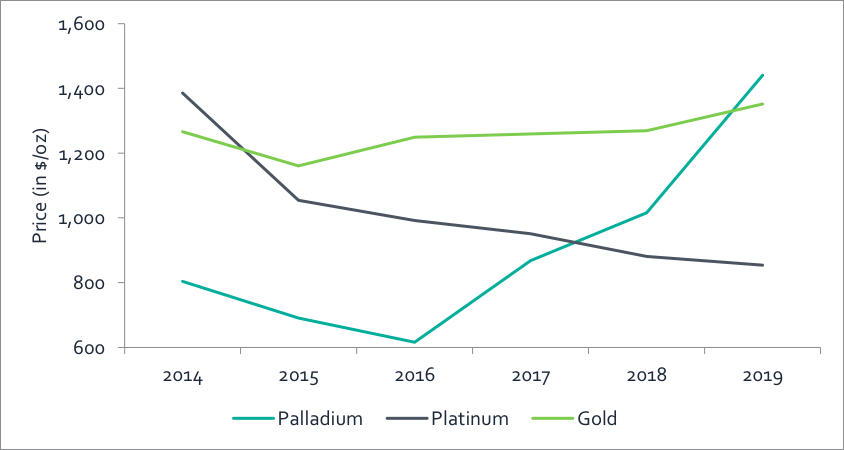

Palladium dethrones gold

Source: The Smart Cube subscribed databases

The ‘electric vehicle revolution’ effect

How long can the palladium boom last? A critical determinant should be the rate of market growth for electric vehicles (EVs) and hybrid electric vehicles (HEVs).

European sales of these relatively ‘clean’ alternatives to diesel and petrol have risen gradually from 3% in 2015 to 6% in 2018, with the associated market buzz compelling investors to flock to metals like lithium, nickel and cobalt; all key components of EV and HEV batteries.

In the overall automotive market, however, EVs and HEVs have yet to make significant inroads, and the overwhelming preference currently is for petrol vehicles over diesel – in turn driving up demand for palladium. Global demand for internal combustion engines (ICEs) is expected to keep growing until 2022 or later, despite increasing adoption of EVs.

The collapse in prices of EV-related battery materials is also setting off alarm bells. With anti-trade rhetoric continuing and the risk of squeezing cashflows therefore mounting, can the automakers afford to sustain huge capex plans to be completely EV-ready any time soon?

More regulation will drive demand – but falling sales may counter it

What is certain is that diesel vehicle markets will see continued erosion as emissions standards become more stringent, especially post Europe’s implementation of the Worldwide Harmonised Light Vehicle Test Procedure (WLTP) in 2017 and the Real Driving Emissions test (RDE) in phases from 2017. Whether this will continue to benefit petrol vehicles at the expense of EVs and HEVs remains to be seen, but either way, the eventual long-term trend will significantly impact demand for palladium.

At the same time, in the near-term, stricter standards are likely to drive increased use of palladium in petrol vehicles. In March 2019, Fiat Chrysler was forced to recall almost a million vehicles in the US and Canada for failing to meet Environmental Protection Agency (EPA) emissions standards. Higher loadings of palladium in the catalytic converters of these – and potentially other – vehicles may be required to achieve compliance.

Overall sales of passenger vehicles are another consideration. In the last couple of years, the global auto industry has come under immense pressure due to falling sales. In China especially, passenger vehicle sales growth moderated to average -4% during 2018-19, vs. +8% during 2013-17.

Finally, some of the key supply-side risks that had been pushing up palladium prices have diffused. The US eventually lifted sanctions against Rusal in January 2019, and in June, Lonmin found a rescuer in Sibanye-Stillwater.

Is palladium about to pass its peak?

Overall, even though palladium has been doing phenomenally well, the odds of its price falling from peak levels seem evenly-poised. With the supply side stabilising and the demand side looking increasingly vulnerable, a palladium correction may well be on its way.

At The Smart Cube, our Financial Services experts regularly analyse developments in the Metals and Mining sector, including forecasting, and modelling market and pricing trends. To find out more about how our Equity Research solution could help you access intelligence and insights related to palladium prices, or other Metals and Mining sector trends, please get in touch.

Our Financial Services solutions help businesses improve operational efficiency with fast access to the research they need. To find out how we support an independent equity research provider to expand stock coverage and drive growth, read this case study.

Additional writing credits go to Ayush John, Analyst.