What is happening in the market?

The commodity market meltdown that started in 2008 and rekindled in 2011 failed to find a bottom until early 2016 when the Bloomberg Commodity Index hit an all-time low. Copper, which is often considered a barometer of global economic health, wasn’t any different either, with its price plummeting to c.$4,300/t from the peak of c.$10,000/t in early 2011. A key reason for this carnage was China losing its economic momentum.

However, what started in 2016 is a surprising rebound in commodity market sentiment. Looking at copper in particular, it galloped 68% to hit a four-year high of $7,200/t in late 2017. While other base metals were a beneficiary of supply rationalisation and/or recovering demand, copper (being the best conductor of electricity) is believed to have gained materially from the growing optimism around electric vehicles (EVs). The Volkswagen “Dieselgate” scandal was another major catalyst for the global auto players to consider a meaningful EV market foray – Tesla being a frontrunner in the race for developing mass market EVs.

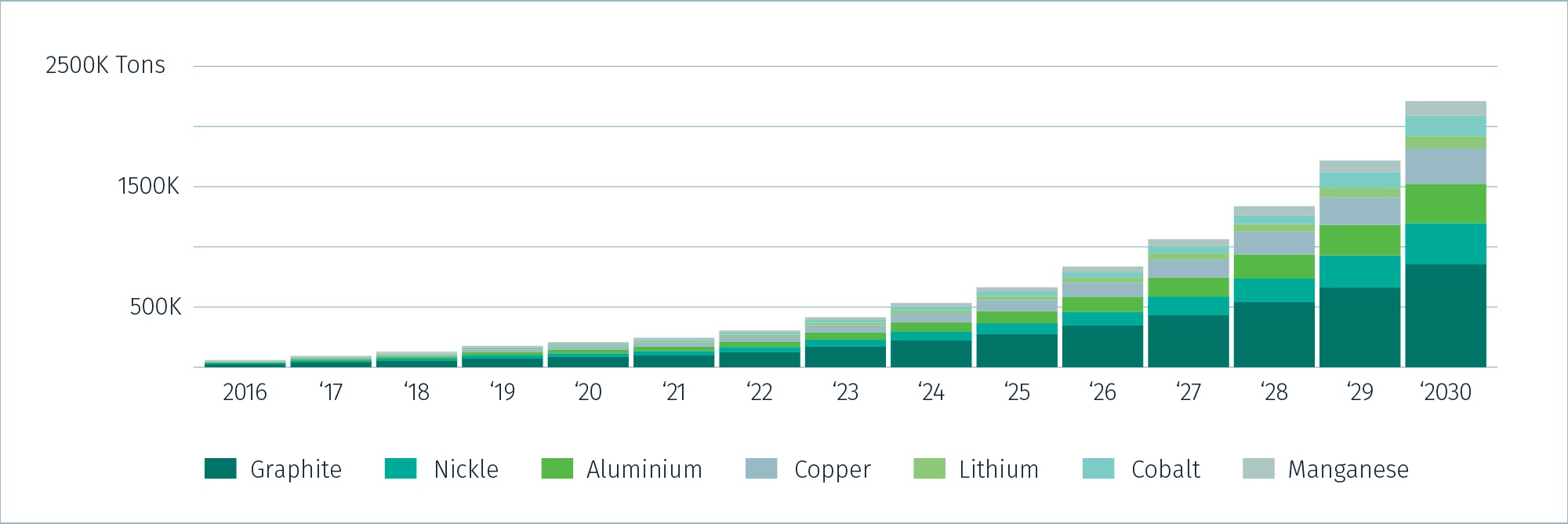

Beneficiaries of uptick in EVs

Source – Copper Development Association

Source – Copper Development Association

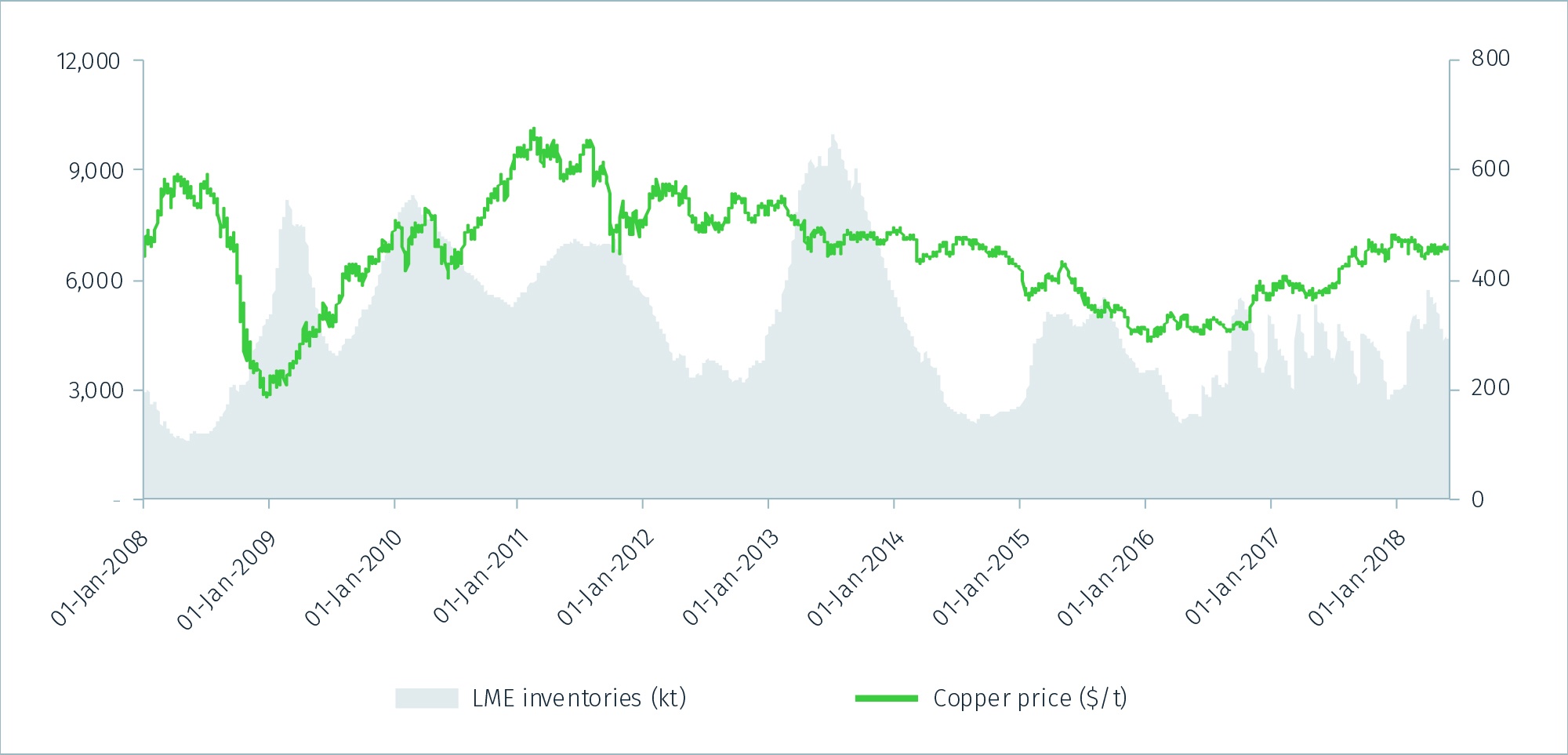

Since Dieselgate, copper prices have registered strong growth but global copper demand has increased by only 1.5% annually. On the other hand, aluminium and zinc’s healthy price gains have been simultaneously supported by strong demand growth (averaging 4% annually). Moreover, LME copper inventories have barely changed since 2015 and there has been a sharp YTD inventory build-up (+58%). One must not forget that 2017 witnessed a number of supply disruptions – including a 44-day strike at Escondida (the world’s largest copper mine) and so, with supply being restored gradually, inventory (and pricing) normalisation shouldn’t be surprising.

Price vs. Inventory

Source – London Metal Exchange

Source – London Metal Exchange

Should we expect any further material price gains for copper?

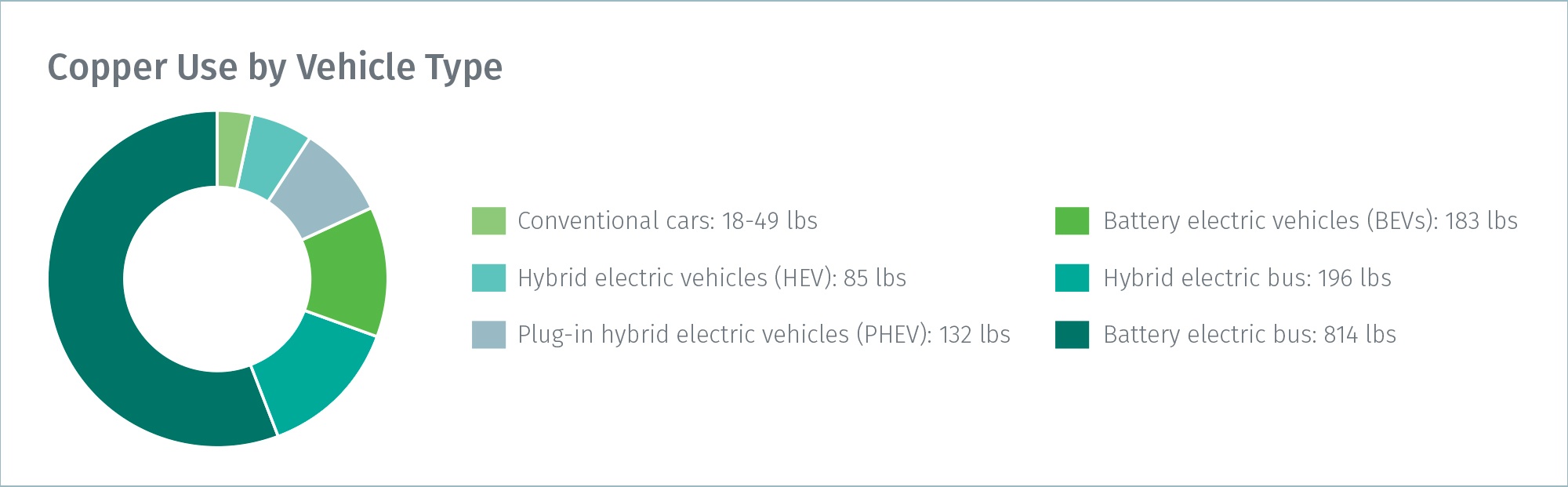

According to a report commissioned by the International Copper Association, copper demand for EVs is expected to increase from 185kt in 2017 to 1.74mt in 2027. While this is stellar growth (8.4x), it would translate into just 0.7% increase in annual copper demand through to 2027 – not a big enough change to push copper prices towards its all-time high, especially since there is ample time for miners to add new capacity (major players including Rio Tinto and BHP Billiton have already finalised capacity addition plans). In the medium-term, most original equipment manufacturers (OEMs) could instead produce more plug-in hybrid vehicles (PHEVs) and gasoline hybrid electric vehicles (GHEVs) to comply with the tightening emission norms, as commercially-viable EV production lines are still being worked out. Interestingly, compared with EVs, PHEVs and GHEVs require 28% and 53% lesser copper content, respectively.

Varying copper application across vehicle types

Source – Copper Development Association

It is also worth noting that the current demand for EVs is largely fuelled by state-sponsored incentives in the US and China, two countries which together accounted for c.75% of 2017 demand. In the US, an EV buyer can enjoy a federal tax credit of up to $7,500, which would be halved if an OEM annually sells more than 200,000 EVs (including select PHEVs). Tesla is likely to cross that mark in 2018 itself. On the other hand, China offers EV incentives of up to $15,000 per car. Such high incentives are unsustainable in the long-term and hence, any reduction in incentives coupled with cheap oil prices could reduce the attractiveness of EVs. Even BMW, one of the biggest OEMs and a pioneer in EV technology, is unsure of the EV demand prospects and, for now, plans to develop a flexible production line capable of manufacturing all three vehicle types – conventional, hybrids and electric.

Another potential impediment for copper comes from its long-standing rival – aluminium. Any sharp uptick in copper prices could compel OEMs to look for ways to use cheaper alternatives (aluminium alloys) for induction motors and wires. With cobalt prices having soared to sky-high levels, OEMs are already trying to change the EV battery chemistry, thereby reducing dependency on expensive metals.

Copper is undoubtedly a beneficiary of the EV euphoria, but any further (medium-term) runaway gains for the red metal seems unlikely.

The Smart Cube helps Financial Services businesses make better-informed investment and lending decisions faster, and drive sustainable growth in a time of unprecedented economic change and disruption. Find out more about our Investment Research and Analytics solutions, including Credit Research and Equity Research.