The long awaited International Maritime Organization (IMO) 2020 regulation, limiting sulphur dioxide emissions from international shipping, came into force on 1 January 2020. The new rule is likely to disrupt the dynamics across the global shipping industry.

The IMO regulation mandates all vessels operating in international waters to lower sulphur emissions by switching to fuel oil with a maximum sulphur content of 0.5%, compared with the previous limit of 3.5%.

In the short run, demand for high-sulphur fuel oil (HSFO/HFO) may decline, while for low-sulphur fuel oil (LSFO) and marine gas oil (MGO) demand is likely to increase. A recent study we conducted among expert stakeholders derived several key insights:

- The price difference between these fuels (HSFO and LSFO) will narrow gradually until 2023 before widening

- The differential may rebound once it reaches a minimum point – after which a price differential of $400–450 could occur between the fuels

- Overall carrier costs (passed onto end users) may increase by 20–25% (depending on the distance)

Installation of scrubbers and switching to burning MGO, LSFO or LNG (liquefied natural gas) are the key ways to comply with the new regulation. Given the high cost of alternative fuels and low availability of LNG, in the long run, most industry players will opt to install scrubbers in order to continue using HSFO – the International Energy Agency (IEA) predicts that ~5,200 scrubbers will be installed by the end of 2024.

How are industry stakeholders responding to the regulation?

With multiple stakeholders involved in marine shipping, we can expect diverse responses.

Industry associations are pushing initiatives to enable high regulatory compliance

Multiple industry associations are undertaking initiatives to ensure a smooth transition for shippers, leading to a higher compliance rate. In September 2019, the International Bunker Industry Association (IBIA) and S&P Global Platts (a provider of information and benchmark prices for the commodities and energy markets) entered into a collaboration agreement to help participants across the shipping ecosystem prepare for the regulation. OPEC forecasts a regulatory compliance rate of 85% in 2020, and this figure is expected to rise to 90% by 2024.

While some countries are refusing to adopt standards or postpone enforcement of the regulation, others are focusing on increasing fuel supply for better compliance

The Indonesian government will not enforce the regulation on its domestic shipping fleet – the only country currently to opt out – primarily due to lack of strategy and investment. Russia is considering delaying enforcement of the rules for domestic operations until 2024, to prevent higher financial pressure on shipowners and provide impetus to the country’s refiners.

However other countries are working to drive compliance, for example Malaysia, which is seeking to overtake Singapore as the bunkering hub in the near future – primarily by increasing its complaint fuel supply.

As a short-term strategy, leading shippers are partnering with refineries to stockpile LSFO

While Maersk signed an agreement with Koole Terminals to produce IMO 2020-compliant fuel, Euronav has anchored a supertanker at the Kuala Linggi International Port (Malaysia), which is set to become Euronav’s refuelling hub, and serve as the floating storage and distribution centre for marine fuel in the region.

Refineries are entering into partnerships or upgrading facilities to increase supply of compliant fuel

In September 2019, Qatar Petroleum and Shell signed an agreement to establish a global LNG bunkering company (a JV owned equally by both parties). Shortly after, in November 2019, global oil refiners (Royal Dutch Shell, Chevron, Gunvor Group and Motiva Enterprises) upgraded their facilities and adjusted operations to raise the output of LSFO and marine gas oil, driven by growing demand for LSFO due to the regulation.

How will prices be impacted?

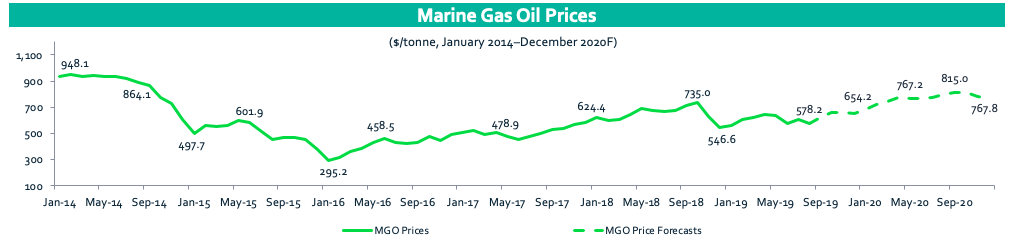

MGO prices are expected to rise 24% Y-o-Y in 2020 on account of the new IMO regulation

Overall, in 2020, demand for distillate fuels with no more than 0.5% sulphur content, e.g. MGO, is forecast to double. However, demand for MGO is likely to subside towards the end of 2020 as ship operators move to cheaper alternatives, such as very low-sulphur fuel oil (VLSFO), and install scrubbers to reduce sulphur emissions.

Source: The Smart Cube estimates and analysis

How are end users reacting to the regulation and its expected impact?

As fuel prices are forecast to be volatile as the regulation comes into effect, end users are proactively taking preventive steps, such as negotiating with shippers to develop a fuel price volatility adjustment mechanism, to minimise the effect of price rises.

For example, in October 2019, Nestlé expressed its intention to focus on combating price uncertainty through a fuel price adjustment mechanism – wherein shipping companies set freight transport prices by taking into account the price volatility for a period of time, rather than directly correlating freight prices to a rise or fall in bunker fuel prices.

We have seen some retailers adopting measures such as altering shipment delivery schedules – by either opting for early delivery or postponing scheduled delivery – to combat short-term potential impacts (such as price fluctuations and transport disruption) of the regulation. In June 2019, Jeff Child (President of Berkshire Hathaway’s RC Willey Home Furnishings) announced that the company opted for a 2-month early delivery schedule, from September–October to July–August, for a shipment of 450 containers of armchairs and sofas from China, to avoid any disruption as the regulation’s date of enforcement approached.

What’s the best way forward?

We have entered 2020 with considerable uncertainty about what the market effects will be. Instead of trying to build a long-term strategy, companies across all stages of the bunker supply chain should focus on formulating and stabilising their short- and medium-term strategies, to weather this period of change.

As a short-term strategy, end users can engage with a shipment carrier firm that is likely to switch to MGO/LSFO (high-priced fuel), or reschedule shipments – receiving early delivery or postponing delivery schedules – to minimise the impact of fuel price volatility.

Once the market stabilises, companies can engage with shipping firms that compute the freight rate by taking into account the price volatility of bunker fuel (through a fuel price volatility adjustment mechanism), or that have installed scrubbers in their fleet to benefit from reduced prices of HFO in the long run.

IMO 2020 will have a ripple effect across industries – businesses must start executing short- and medium-term plans to successfully navigate the months ahead.

The Smart Cube helps companies across sectors, from Industrials to CPG, assess the impact of market disruptions through its intelligence and analytics solutions.

To talk about how we can help you better understand the impact of the IMO 2020 regulation and track recent developments in this space, please email us at info@thesmartcube.com.